Fiscal restraint and investment

- Introduction

- History

- What’s the problem?

- Some potential responses

- Conclusions

- References

- Download this position paper

Introduction

Any country’s system for providing retirement income has to be affordable over the long term. In New Zealand’s case, where New Zealand Superannuation (NZS) is the sole or principal source of income for a majority of retirees and the cost of NZS is met through taxation, the Government must be in a fiscal position sound enough to meet those costs alongside other priorities for expenditure. “Soundness” is determined by the balance between the Government’s revenues and expenditures, and is strongly influenced by net debt levels.

Prudent Government fiscal and monetary management also has an impact on the economy at large. Taxes can have an inhibiting effect on economic growth and persistent deficits contribute to a building up of debt. If not dealt with early enough, debt can grow to levels which compromise intergenerational equity, economic performance, fiscal sustainability and resilience to shocks such as natural disasters or banking crises (Auerbach, 2008; Buckle & Cruickshank, 2012). On the other hand, well-targeted Government expenditure can promote growth, raise living standards and make NZS more affordable. Private savings behaviour may also be encouraged through retirement income policies and financial education to create a source of domestic funds for investment. Indeed, the objectives of retirement income policy have become conflated with the need for national savings and debt reduction (Savings Working Group, 2011).

The New Zealand Treasury is required to produce a statement on the Government’s long-term fiscal position every four years. These statements provide 40-year projections, identify challenges that will face future governments – such as those arising from society's ageing population – and provide members of the public with information on evidence-based options for meeting those challenges. The next statement will be published in July 2013[1]. But it is already clear that along with health and taxes, NZS is a major driver of the long-term fiscal projections (Rodway, 2012).

It should be noted that the focus of this paper is on fiscal restraint (the Government’s spending) rather than the wider economy from which the future costs of retirement income will have to be met. The extent to which those costs are met publicly or privately, and whether out of taxation or savings, are matters for debate.

History

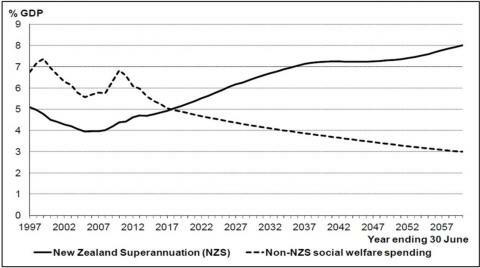

Gross public pension expenditure in New Zealand hovered around 3% of GDP between 1950 and the mid-1970s when it suddenly spiked to 7% with the introduction of universal, wage-linked National Superannuation (the forerunner of NZS) which was paid at a very high rate from the age of 60. In 1991 there was a temporary freeze in NZS inflation adjustments and between 1992 and 2001 the age of eligibility was raised back to 65. Another policy initiative to introduce tight income testing of NZS failed because of public resistance, but even so the cost of NZS fell once more to 4% of GDP, a proportion that has not changed much since (this proportion is about half the OECD average). However, projections show that the cost of NZS will nearly double to 8% of GDP by the middle of this century – three quarters of the projected OECD average in 2050 (Kirkup & Kengmana, 2012).

It could be argued that the relative cost of New Zealand’s main pension is not great as a proportion of GDP in a developed economy. However, other OECD countries are finding their pension arrangements to be unsustainable and the projected doubling of the cost of NZS is of concern. In response, the 2010 review of retirement income policy made two recommendations to reduce the cost of NZS as a proportion of GDP:

- A gradual increase in the age of eligibility for NZS from 65, starting in 2020 and rising by two months a year until it reached 67 in 2033[2]; and

- A change in the indexation of NZS to reduce the rate at which it increased, but with a “floor” to ensure that purchasing power would be maintained.

There was also a recommendation to mitigate any hardship experienced by those disadvantaged by the change in age of eligibility. The net effect of these recommendations would have been to reduce the cost of NZS to approximately 6% of GDP by 2050. However the Government elected not to accept any of the above recommendations.

What’s the problem?

The fiscal gap and debt

New Zealand’s total national debt is very high but compared to most other OECD countries, the proportion of that debt owed by the Government is relatively low as a percentage of GDP. (Savings Working Group, 2011). However, in common with many other developed economies, the New Zealand Government is facing the prospect of a worsening situation as the result of an increasing gap between its expenditure and revenue gathered through taxation. This gap is projected to grow over the next few decades at a greater rate than previously, largely due to cost pressures associated with an ageing population. One way of closing the gap is through incurring more debt but there are risks inherent in such a path as the cost of servicing debt becomes part of outstanding balances, which then start to grow exponentially. There can come a point where debt levels are so high that lenders lose confidence in our ability to repay, and either refuse to lend more or charge a premium to cover their risk. As the cost of borrowing increases, the cycle of increasing debt picks up apace.

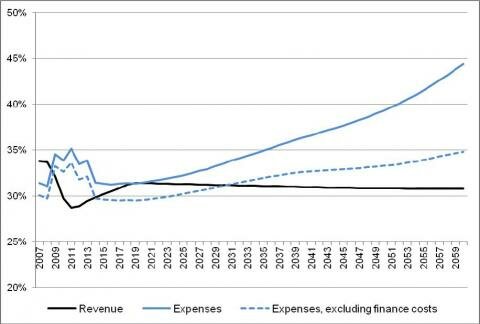

Figure 1: Government revenue and expenses as a percentage of GDP, 2007-2060

Source: (Buckle & Cruickshank 2012)[3]

Along with the health budget, NZS is projected to be a major driver of increasing costs. Because the population due to reach the age of 65 progressively over the next four decades is fairly well known, and notwithstanding uncertainties over increases in life expectancy, the future costs of NZS can be calculated with a fair degree of accuracy. Indeed, it is possible to estimate the size of the Government’s future liability for NZS, although this is contentious and needs to be offset against assets on the Government’s balance sheet (Auerbach, 2008).

Figure 2: Core Crown demand-based Social Welfare Spending/GDP: under Cost Pressures

Source: Bell, 2012[4]

National savings and investment

Saving at the level of individuals and households is discussed in the position papers on “Voluntary savings” and “Intergenerational equity”[5]. From the national point of view, the Savings Working Group (2011) argues that insufficient domestic saving lies behind New Zealand’s high levels of indebtedness to the rest of the world.

New Zealand’s saving rate is low by international standards. Since 1975, net national saving (after adjustment for consumption of fixed capital) has averaged just 2.9% of GDP. Private saving has been declining for the last two decades and post 2003 has fallen steeply to become negative, with a pick-up in the last two years.

Our low rate of domestic saving means that our capital markets are “thin” and we have to rely on overseas sources of investment capital. The resulting large net foreign liabilities position causes two economic problems that the Savings Working Group (SWG) believes are serious and increasingly urgent. Firstly, it makes the New Zealand economy very vulnerable to shocks, and secondly it has an adverse impact on New Zealand’s economic performance, especially growth.

The SWG also argues that New Zealanders are not saving enough for retirement, but there are differing views on this point, in part because of difficulties of measuring what is actually going on (Scobie, Gibson et al., 2004; Law, Meehan et al., 2011; Savings Working Group, 2011). However, the introduction over the last decade of KiwiSaver and the New Zealand Superannuation Fund (NZSF) provides additional mechanisms through which saving behaviour might be influenced through policy. NZS, KiwiSaver and the NZSF are key elements of a framework within which the balance between “Pay as you go” and “Save as you go” funding of retirement income can be adjusted[6].

Some potential responses

At a high level, measures to address the so-called “fiscal gap” and reduce Government debt as a proportion of GDP might focus on either growing the economy, reducing expenditure, increasing revenue, or a mix of these. There are also decisions to be taken about targets and the trajectory for reducing debt. These decisions are a matter of judgement which involve trade-offs between objectives (Auerbach, 2008). Sutherland et al. (2012, cited in Buckle & Cruickshank, 2012) estimate that for New Zealand a two-year delay in fiscal adjustment increases the fiscal gap by more than one-third of a percentage point of GDP. In other words, the sooner we start the adjustment, the sooner we’ll get the debt genie back in the bottle.

But there may also be risks in deciding too soon, imposing transition costs which “tie our hands” (Wilkinson, 2012) and ultimately prove to have been unnecessary.

So there are two schools of thought on the timing of decisions and the implementation of change. But even though we can’t predict the future or how future generations will respond to events as they unfold, some decisions can be made now on the basis of the (imperfect) information available to us in the present. Given the uncertainty that exists, it would also seem sensible to allow for re-computation of the path as circumstances change (Auerbach, 2008).

As far as the costs of NZS are concerned, a one-off saving could be achieved through a gradual raising of the age of eligibility. This will probably not be enough on its own and consideration may need to be given to continuous review of the age in light of actual increases in longevity.

Another option is to target NZS more specifically on the basis of need, through means testing. However, there are transaction costs involved in means testing and considerable uncertainty about the net savings to be gained. Means testing also brings risks of discouraging private saving and incentivising undesirable behaviour such as concealment of income and assets[7].

The biggest savings would come from changes in the formula by which increases in NZS are indexed – whether to wages, prices or a mix of both (Kirkup & Kengmana, 2012).

Whatever path is chosen, the rate of transition will need to be matched to growth in private and collective savings, and care taken to protect and bolster other policies and programmes that contribute to wellbeing in retirement, for example affordable housing, access to health care and other services, and employment opportunities for older people. In some cases, there is the potential to generate a virtuous cycle of both direct and indirect contributions to improvements in the fiscal position. For example, incentivising increased labour force participation assists by increasing tax revenues required to fund NZS and the NZSF (Crossan, 2010; Buckle & Cruickshank, 2012).

Change also needs “buy-in” from the wider community, based on open communication and full discussion of the issues around retirement income policy, and a long enough lead time for people to make adjustments in their own planning.

Reforms are more successful where the public understand why fiscal adjustment is needed, and where there is public support for debt or deficit reduction and measures for it to be achieved. (Buckle & Cruickshank, 2012)

Conclusions

New Zealand’s system for providing retirement income has to be affordable over the long term, and while it could be argued that New Zealand Superannuation is already affordable, the projected doubling of its cost as a proportion of GDP is a concern. Raising more debt to fill the gap between Government revenues and expenditures is not a sustainable path and other measures will need to be considered. While there may be arguments about the extent to which New Zealanders’ savings for retirement are adequate, there is a strong argument for encouraging more private and/or collective saving behaviour as a part of the overall retirement income framework.

There are a number of options for proceeding towards a new balance of funding, but any transition will need to be at a politically sustainable rate. Change needs “buy-in” from the wider community, and this will come from open and full discussion of the issues and implementation at a reasonable rate, to allow time for New Zealanders to make adjustments to their plans.

References

Auerbach, A. J. (2008). Long-term Objectives for Government Debt. Fiscal Policy and Labour Market Reforms. Stockholm, University of California, Berkely: 42.

Bell, M. (2012). Fiscal Sustainability Under an Ageing Population Structure: Paper for the long-term fiscal external panel. New Zealand Treasury. Wellington: 27.

Buckle, R. A. & Cruickshank, A. A. (2012). The Requirements for Long-Run Fiscal Sustainability: Paper for the long-term fiscal external panel. New Zealand Treasury. Wellington: 39.

Crossan, D. (2010). Review of Retirement Income Policy. Wellington, Retirement Commission: 144.

Law, D., Meehan, L., et al. (2011). KiwiSaver: An Initial Evaluation of the Impact on Retirement Saving. New Zealand Treasury. Wellington: 37.

Rodway, P. (2012). Long Term Fiscal Projections: Reassessing Assumptions, Testing New Perspectives. New Zealand Treasury. Wellington: 38.

Savings Working Group (2011). Saving New Zealand: Reducing Vulnerabilities and Barriers to Growth and Prosperity. Final report to the Minister of Finance. Wellington: 161.

Scobie, G., Gibson, J., et al. (2004). Saving for Retirement: New Evidence for New Zealand. New Zealand Treasury. Wellington: 28.

Sutherland, D., Hoeller, P. & Merola, R. (2012). Fiscal consolidation: Part 1. How much is needed and how to reduce debt to a prudent level. OECD Economics Department Working Paper No. 932.

Wilkinson, T. M. (2012). Intergenerational Ethics and Long-Term Fiscal Planning: Paper for the long-term fiscal external panel. University of Auckland: 22.

[1] For more description of the long term fiscal statement process and to access background papers containing detailed analysis, see http://www.treasury.govt.nz/government/longterm/externalpanel and http://www.victoria.ac.nz/sacl/about/chair-in-public-finance/events/long-term-fiscal-external-panel

[2] Many other OECD countries are adopting similar measures – for a summary see https://cflri.org.nz/sites/default/files/docs/RI-OECD-Countries-Pension-Ages-2012.pdf (PDF 143 KB, Sep 2013)

[3] See http://www.treasury.govt.nz/government/longterm/externalpanel/session1

[4] See http://www.treasury.govt.nz/government/longterm/externalpanel/session1

[5] See https://cflri.org.nz/retirement-income/policy-positions

[6] See the position paper on “Income support”.

[7] See the position paper on “Encouraging personal responsibility, individual choice and control”.

Download this position paper

Fiscal restraint and investment (PDF 488.49 KB, Jan 2013)